E-invoicing is rapidly transforming the business landscape globally, and Riyadh is at the forefront of this change in Saudi Arabia. E-invoicing or electronic invoicing, allows businesses to streamline their billing processes, enhance compliance and achieve significant operational efficiencies. In Riyadh, the adoption of e-invoicing is essential due to regulations set by the Zakat, Tax and Customs Authority (ZATCA). This blog will provide an in depth look at e-invoicing in Riyadh covering its benefits, compliance requirements and how to select the best ZATCA approved e-invoicing in Riyadh.

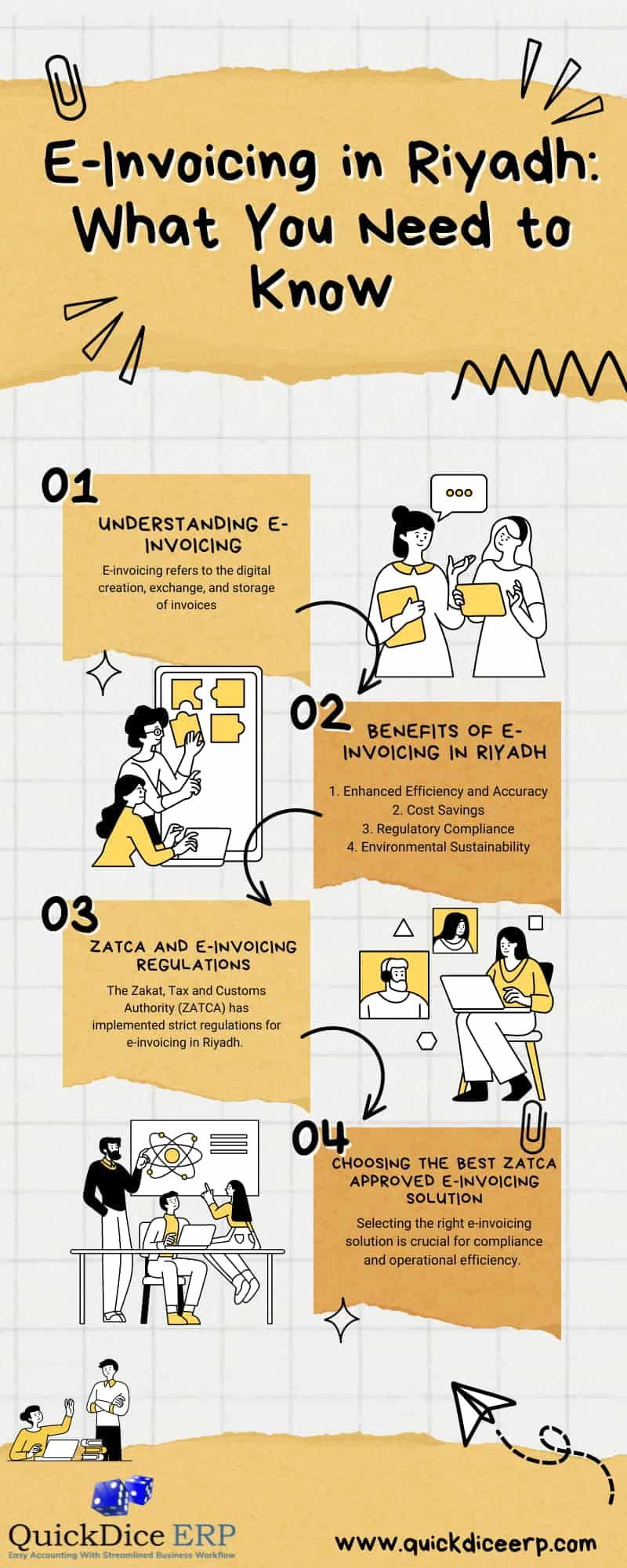

Understanding E-Invoicing

E-invoicing refers to the digital creation, exchange, and storage of invoices. Unlike traditional paper invoices, e-invoices are generated, transmitted, and processed electronically, minimizing manual errors and speeding up the payment cycle. E-invoicing in Riyadh is becoming increasingly important as businesses move towards digital transformation and compliance with local regulations.

Benefits of E-Invoicing in Riyadh

1. Enhanced Efficiency and Accuracy

E-invoicing automates the entire invoicing process, significantly reducing the time spent on manual data entry and processing. This automation minimizes errors ensuring that financial records are accurate and up to date.

2. Cost Savings

Switching to e-invoicing eliminates the need for paper, printing, and postage, leading to substantial cost savings. Additionally faster invoice processing improves cash flow management which is vital for business sustainability.

3. Regulatory Compliance

ZATCA regulations mandate the use of e-invoicing for all taxable entities in Riyadh. E-invoicing solutions help businesses comply with these regulations avoiding penalties and ensuring smooth audits and tax filings.

4. Environmental Sustainability

Reducing the reliance on paper invoices contributes to environmental sustainability. E-invoicing is an eco friendly alternative that aligns with global efforts to reduce carbon footprints.

ZATCA and E-Invoicing Regulations

The Zakat, Tax and Customs Authority (ZATCA) has implemented strict regulations for e-invoicing in Riyadh. These regulations aim to improve tax collection efficiency, combat tax evasion and support the digital transformation of the economy.

Key Requirements

- Electronic Format: Invoices must be issued, transmitted, and stored in an electronic format that ensures data integrity and authenticity.

- Mandatory Data Elements: E-invoices must include specific data elements as required by ZATCA, such as buyer and seller information, invoice date, and a unique invoice number.

- Secure Archiving: Businesses must securely store e-invoices for a specified period, ensuring they are accessible for audits and compliance checks.

- Integration with ZATCA Systems: E-invoicing solutions must integrate with ZATCA’s systems to facilitate real-time data sharing and compliance monitoring.

Choosing the Best ZATCA Approved E-Invoicing Solution

Selecting the right e-invoicing solution is crucial for compliance and operational efficiency. Here are some factors to consider when choosing the best ZATCA approved e-invoicing in Riyadh:

1. ZATCA Approval

Ensure that the e-invoicing software is approved by ZATCA. ZATCA approved e-invoicing in Riaydh comply with all regulatory requirements and offer features necessary for compliance.

2. Integration Capabilities

The e-invoicing solution should seamlessly integrate with your existing accounting and ERP systems. This integration ensures smooth data flow and minimizes disruptions to your business processes.

3. User-Friendly Interface

A user-friendly interface is essential for quick adoption by your team. The software should be easy to use, with clear instructions and comprehensive support resources.

4. Robust Security Features

Data security is paramount. The chosen e-invoicing solution should offer robust security features, including encryption and secure access controls, to protect sensitive financial information.

5. Scalability

Consider the scalability of the solution. As your business grows, the e-invoicing system should be able to handle increased transaction volumes without compromising performance.

Implementing E-Invoicing in Your Business

Transitioning to e-invoicing requires careful planning and execution. Here are the steps to implement e-invoicing in your business in Riyadh:

1. Assess Your Current Systems

Evaluate your existing invoicing and accounting systems to identify any gaps or areas that need improvement. Understanding your current setup will help in selecting a compatible e-invoicing solution.

2. Choose a ZATCA Approved Solution

Research and select a ZATCA approved e-invoicing solution that fits your business needs. Consider factors such as features, cost, and vendor support.

3. Train Your Team

Provide comprehensive training to your staff on the new e-invoicing system. Ensure they understand the benefits, functionalities, and compliance requirements.

4. Integrate and Test

Integrate the e-invoicing solution with your existing systems and conduct thorough testing to ensure everything works seamlessly. Address any issues before going live.

5. Go Live and Monitor

Once everything is set up, start using the e-invoicing system for your transactions. Monitor the process closely to identify any initial hiccups and make necessary adjustments.

Conclusion

E-invoicing in Riyadh is not just about regulatory compliance; it is a strategic move towards greater efficiency, cost savings, and environmental sustainability. By choosing the best ZATCA approved e-invoicing solution and implementing it effectively, businesses can ensure compliance while reaping the numerous benefits of digital invoicing. As Riyadh continues to embrace digital transformation, e-invoicing stands out as a crucial component for modern business operations.

E-invoicing is transforming how businesses operate, offering numerous benefits and ensuring compliance with ZATCA regulations. By choosing the best ZATCA approved e-invoicing solution, businesses in Riyadh can streamline their invoicing processes, enhance efficiency, and contribute to a sustainable future. As the digital landscape evolves, e-invoicing will play a vital role in shaping the future of business operations in Riyadh and beyond.

Comments on “E-Invoicing in Riyadh: What You Need to Know”